Latest Updates

-

Republic Day 2026: Complete Guide To Ticket Booking Dates, Prices And How To Watch The Parade Live

Republic Day 2026: Complete Guide To Ticket Booking Dates, Prices And How To Watch The Parade Live -

Remembering Irrfan Khan On His 59th Birth Anniversary Through The Characters That Still Stay With Us

Remembering Irrfan Khan On His 59th Birth Anniversary Through The Characters That Still Stay With Us -

Daily Horoscope, Jan 07, 2026: Libra to Pisces; Astrological Prediction for all Zodiac Signs

Daily Horoscope, Jan 07, 2026: Libra to Pisces; Astrological Prediction for all Zodiac Signs -

Building A Sustainable Wardrobe: Small Changes That Make A Big Impact This Winter

Building A Sustainable Wardrobe: Small Changes That Make A Big Impact This Winter -

Gold Rate In India Continues Rally on Jan 6 as Global Tensions Fuels Demand; Silver Up Rs.12,000 in Two Days

Gold Rate In India Continues Rally on Jan 6 as Global Tensions Fuels Demand; Silver Up Rs.12,000 in Two Days -

Rukmini Vasanth Enters Yash's 'Toxic' World As Mellisa In Striking New Poster Reveal

Rukmini Vasanth Enters Yash's 'Toxic' World As Mellisa In Striking New Poster Reveal -

Kartik Aaryan’s Goa Getaway Sparks Dating Rumours After Viral Beach Photos Surface Online

Kartik Aaryan’s Goa Getaway Sparks Dating Rumours After Viral Beach Photos Surface Online -

Happy Birthday A.R. Rahman: Inside The Net Worth, Global Fame And Luxury Lifestyle Of 'The Mozart Of Madras'

Happy Birthday A.R. Rahman: Inside The Net Worth, Global Fame And Luxury Lifestyle Of 'The Mozart Of Madras' -

Sakat Chauth 2026 Vrat Katha: Know The Powerful Story Behind This Sacred Fast

Sakat Chauth 2026 Vrat Katha: Know The Powerful Story Behind This Sacred Fast -

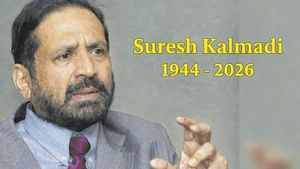

Suresh Kalmadi Passes Away At 81: Tracing His Political And Sports Career Rise Amid Controversies

Suresh Kalmadi Passes Away At 81: Tracing His Political And Sports Career Rise Amid Controversies

Gold Rate in India Today, Jan 5: 24K, 22K Prices Surge as US-Venezuela Crisis Sparks Buying; Silver Rallies

Gold

rate

in

India

today

saw

a

strong

jump

after

a

fall

seen

on

the

weekend.

Over

the

last

week,

24-karat

gold

rates

in

India

had

dropped

sharply

by

more

than

4%,

slipping

from

record-high

levels.

But

today,

gold

prices

in

India

bounced

back,

and

there's

a

big

reason

behind

this

sudden

change.

The main reason for the rise in gold prices is global tension caused by the US-Venezuela conflict that arose on Jan 3rd.

On Saturday, US President Donald Trump announced that the United States has captured Venezuelan President Nicolas Maduro, which escalated geopolitical tensions and lifted safe-haven demand. This sudden demand pushed spot gold prices up by almost 2% as the market opened today. If global tensions remain high, gold prices in India could continue to rise.

Gold Rate in India Today

As of January 5th Monday, 24-carat gold rates in India surged by Rs. 1580 per 10 grams to cost Rs. 1,37,400. While the 22-carat gold price in India jumped massively by Rs.1450 per 10 grams, to cost Rs. Rs. 1,25,950. Just like that, the 18-carat gold rates spiked by Rs. 1,180 to retail at Rs. 1,03,050 per 10 grams.

Similarly, 100 grams of 24-carat gold rates now retail at Rs 13,74,000, and the 22-carat gold rates per 100 grams now cost Rs 12,59,500.

Silver prices in India today

Silver rates in India today also jumped after yesterday's stability. On the 5th of January, 1 kg of silver in India cost Rs. 2,47,000 after rising by Rs. 6,000. While 100 g of silver rates in India retail at Rs 24,700, which jumped by Rs 600.

City-Wise Gold Rates: Latest 22-Carat & 24-Carat Prices Across India

The latest gold prices for 22-carat and 24-carat gold in major Indian cities are similar to national gold prices today.

The current 24-carat gold price in Chennai is Rs. 1,38,330 per 10 grams, while the 22-carat gold price in Chennai stands at Rs.1,26,800 per 10 grams.

As of today, the 22-carat gold rate in Bangalore stands at Rs. 1,25,950. per 10 grams, whereas the 24-carat gold rate in Bangalore is Rs. 1,37,400 per 10 grams.

The 22K gold price in Hyderabad is Rs. 1,25,950. per 10 grams, while the 24K gold price in Hyderabad is Rs. 1,37,400 per 10 grams.

The 22-carat gold in Mumbai is Rs. 1,25,950. per 10 grams, whereas the 24-carat gold price in Mumbai stands at Rs. 1,37,400 per 10 grams.

MCX Gold Price and Silver Price

Currently, gold futures prices on the MCX, which are going to mature on February 5th, are trading at Rs.1,37,299 jumping 1.13%. Similarly, silver futures prices set to mature on March 5th, are trading at Rs. 2,42,995 with a rise of 2.83%.

Gold Prices Target and Outlook This Week

"Gold prices climbed over 1% to near $4,400 per ounce as geopolitical tensions stemming from US action in Venezuela boosted safe-haven demand, while markets also await key US data and Fed signals on interest rates." As per the Way to Wealth Commodity Report

"On the technical front, MCX Gold has witnessed its first major dip in the recent past and is now trading near its crucial 20 DEMA momentum support zone. Any break below the 20 DEMA line could invite further selling pressure. Over the last four sessions, prices have been consolidating in a very narrow range, indicating a lack of momentum. However, the broader trend continues to remain positive. Immediate resistance is placed at 140,440, while support is seen at 134,300. Since the trend remains bullish, traders can consider buying MCX Gold near 135,000 for a target of 139,400, with a stop-loss placed below 133,950. " the report further added.

Spot Gold Price and Spot Silver Rate

According to the latest report from Reuters,As of 0312 GMT, spot gold climbed 1.9% to $4,411.14 per ounce, a one-week high. U.S. gold futures for February delivery gained 2.1% to $4,419.90. Meanwhile, Spot silver added 4.4% to $75.82 per ounce."

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of Goodreturns.in or Greynium Information Technologies Private Limited (together referred as "we"). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Credit: Goodreturns

Click it and Unblock the Notifications

Click it and Unblock the Notifications