Latest Updates

-

The Fertility Fear Loop: Expert Explains How Social Pressure Affects Women’s Reproductive Health

The Fertility Fear Loop: Expert Explains How Social Pressure Affects Women’s Reproductive Health -

New Year’s Day Movie List: Movies to Watch to Start 2026 the Right Way

New Year’s Day Movie List: Movies to Watch to Start 2026 the Right Way -

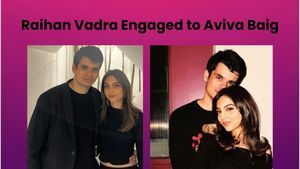

Priyanka Gandhi’s Son Raihan Vadra Engaged to Longtime Girlfriend Aviva Baig

Priyanka Gandhi’s Son Raihan Vadra Engaged to Longtime Girlfriend Aviva Baig -

Big Crash in Gold Rate Today in India; Silver Prices Down on 30 Dec Ahead of New Year – Should You Book Profit or Hold on Gold & Silver Investments?

Big Crash in Gold Rate Today in India; Silver Prices Down on 30 Dec Ahead of New Year – Should You Book Profit or Hold on Gold & Silver Investments? -

Post-Party Recovery: How to Reset Sleep, Gut, and Energy After the Holiday Season

Post-Party Recovery: How to Reset Sleep, Gut, and Energy After the Holiday Season -

Cricketer Sneh Rana Meets Deepika Padukone, Calls It a Childhood Dream Come True

Cricketer Sneh Rana Meets Deepika Padukone, Calls It a Childhood Dream Come True -

Lighting Trends 2026: Minimalist Design, Smart Innovation, and a Warm Sense of Comfort

Lighting Trends 2026: Minimalist Design, Smart Innovation, and a Warm Sense of Comfort -

Dinner, Drinks Or Dance Floor? Where To Dine And Party On New Year’s Eve 2025 Across Delhi NCR

Dinner, Drinks Or Dance Floor? Where To Dine And Party On New Year’s Eve 2025 Across Delhi NCR -

Paush Putrada Ekadashi 2025: Why The Final Ekadashi Of The Year Holds Deeper Significance

Paush Putrada Ekadashi 2025: Why The Final Ekadashi Of The Year Holds Deeper Significance -

Daily Horoscope, Dec 30, 2025: Libra to Pisces; Astrological Prediction for all Zodiac Signs

Daily Horoscope, Dec 30, 2025: Libra to Pisces; Astrological Prediction for all Zodiac Signs

Your PAN Card May Stop Working From December 31, What Every Taxpayer Must Know

PAN-Aadhaar Linking Deadline Ends December 31: The deadline to link Aadhaar with PAN is set to expire on December 31, 2025, leaving taxpayers with little time to complete the mandatory process.

Failure to do so will result in the PAN becoming inoperative, affecting several financial and tax-related activities. The Income Tax Department has reiterated that users missing the deadline will also be required to pay a penalty before completing the linkage.

What Happens If PAN Is Not Linked by December 31

According to the Income Tax Department, PAN cards that are not linked with Aadhaar by the stipulated deadline will become inoperative. This means taxpayers will be unable to use their PAN for essential transactions, including filing income tax returns, opening bank accounts, or carrying out high-value financial dealings.

The department has made it clear that linking after the deadline will still be allowed, but only after paying a late fee of ₹1,000. The PAN will remain inactive until the linking process is completed successfully.

Late Fee Details for PAN-Aadhaar Linking

Taxpayers attempting to link their PAN with Aadhaar after December 31, 2025, will have to pay a penalty of ₹1,000. The fee must be paid online before the linking request is processed.

Only after the payment is confirmed can the Aadhaar be linked with the PAN. The PAN will continue to remain inoperative until the process is fully completed.

Step-by-Step Guide to Link PAN With Aadhaar

To link PAN and Aadhaar, users need to visit the official income tax e-filing portal and log in using their credentials. After logging in, they must go to the profile section and select the 'Link Aadhaar' option.

Users are required to enter their PAN and Aadhaar details and proceed to pay the fee using the 'e-Pay Tax' option. The relevant assessment year should be selected, and the payment type must be chosen as 'Other Receipts'. Once the payment is completed, Aadhaar can be linked with the PAN.

To check the status of the linking request, users can click on the 'Link Aadhaar Status' option and enter their PAN and Aadhaar numbers.

What to Do in Case of Errors or Multiple PAN Linkage

If there are discrepancies in the details of Aadhaar or PAN, taxpayers should visit the official portals of UIDAI or UTIITSL to get the information corrected before attempting to link.

In cases where an Aadhaar number is already linked with another PAN, users must approach their Jurisdictional Assessing Officer and submit a request for delinking.

For individuals applying for a new PAN card, Aadhaar-based verification has now been made mandatory at the time of application. This step has been introduced to eliminate the need for linking PAN and Aadhaar separately in the future.

Credit: Oneindia

Click it and Unblock the Notifications

Click it and Unblock the Notifications