Latest Updates

-

Purported Video of Muslim Mob Lynching & Hanging Hindu Youth In Bangladesh Shocks Internet

Purported Video of Muslim Mob Lynching & Hanging Hindu Youth In Bangladesh Shocks Internet -

A Hotel on Wheels: Bihar Rolls Out Its First Luxury Caravan Buses

A Hotel on Wheels: Bihar Rolls Out Its First Luxury Caravan Buses -

Bharti Singh-Haarsh Limbachiyaa Welcome Second Child, Gender: Couple Welcome Their Second Baby, Duo Overjoyed - Report | Bharti Singh Gives Birth To Second Baby Boy | Gender Of Bharti Singh Haarsh Limbachiyaa Second Baby

Bharti Singh-Haarsh Limbachiyaa Welcome Second Child, Gender: Couple Welcome Their Second Baby, Duo Overjoyed - Report | Bharti Singh Gives Birth To Second Baby Boy | Gender Of Bharti Singh Haarsh Limbachiyaa Second Baby -

Bharti Singh Welcomes Second Son: Joyous News for the Comedian and Her Family

Bharti Singh Welcomes Second Son: Joyous News for the Comedian and Her Family -

Gold & Silver Rates Today in India: 22K, 24K, 18K & MCX Prices Fall After Continuous Rally; Check Latest Gold Rates in Chennai, Mumbai, Bangalore, Hyderabad, Ahmedabad & Other Cities on 19 December

Gold & Silver Rates Today in India: 22K, 24K, 18K & MCX Prices Fall After Continuous Rally; Check Latest Gold Rates in Chennai, Mumbai, Bangalore, Hyderabad, Ahmedabad & Other Cities on 19 December -

Nick Jonas Dancing to Dhurandhar’s “Shararat” Song Goes Viral

Nick Jonas Dancing to Dhurandhar’s “Shararat” Song Goes Viral -

From Consciousness To Cosmos: Understanding Reality Through The Vedic Lens

From Consciousness To Cosmos: Understanding Reality Through The Vedic Lens -

The Sunscreen Confusion: Expert Explains How to Choose What Actually Works in Indian Weather

The Sunscreen Confusion: Expert Explains How to Choose What Actually Works in Indian Weather -

On Goa Liberation Day 2025, A Look At How Freedom Shaped Goa Into A Celebrity-Favourite Retreat

On Goa Liberation Day 2025, A Look At How Freedom Shaped Goa Into A Celebrity-Favourite Retreat -

Daily Horoscope, Dec 19, 2025: Libra to Pisces; Astrological Prediction for all Zodiac Signs

Daily Horoscope, Dec 19, 2025: Libra to Pisces; Astrological Prediction for all Zodiac Signs

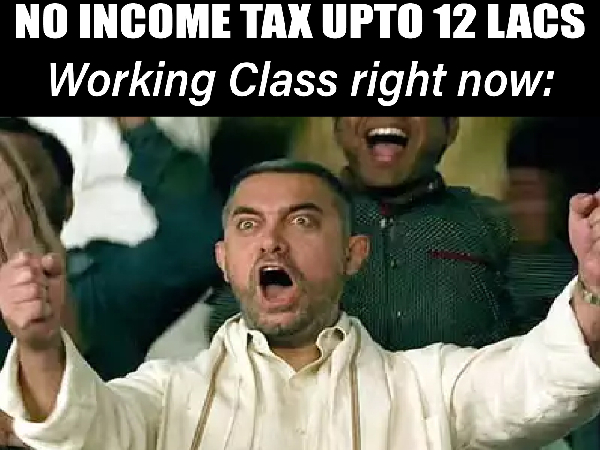

Middle-Class Relief? : How Netizens Reacted To The New Tax Regime In Union Budget 2025

The Union Budget 2025 has made waves with the announcement of a new tax regime that promises significant relief for the middle class. Finance Minister Nirmala Sitharaman unveiled a restructured income tax system, with a key feature being the exemption of income up to Rs 12 lakh from taxes.

This move, which simplifies tax filing and increases financial relief, has garnered a lot of attention, especially on social media platforms, where netizens have expressed their excitement and approval. While the general consensus has been overwhelmingly positive, there have also been concerns raised about the new system's potential complexities.

The Big Change : No Tax On Income Up To Rs 12 Lakh

One of the most notable aspects of the new tax regime is the exemption of income up to Rs 12 lakh from tax, which benefits a large section of India's working middle class. The revised tax slabs are as follows:

0

to

4

lakh

-

No

tax

4

lakh

to

8

lakh

-

5%

8

lakh

to

12

lakh

-

10%

12

lakh

to

16

lakh

-

15%

16

lakh

to

20

lakh

-

20%

20

lakh

to

24

lakh

-

25%

Above

24

lakh

-

30%

This structure aims to ease the tax burden for those in the lower and middle-income groups, providing immediate relief. For example, individuals earning Rs 12 lakh will save around Rs 80,000 annually, while those with an income of Rs 18 lakh will enjoy a saving of Rs 70,000. The higher income brackets, too, will see tax benefits, with Rs 25 lakh earners saving Rs 1.10 lakh. These adjustments have been designed to boost disposable income, which could potentially drive consumption and savings in the economy.

Netizens Celebrate : The Social Media Frenzy

The moment the new tax regime was announced, social media platforms exploded with reactions from netizens, who widely celebrated the move. Twitter, Facebook, and Instagram were flooded with positive posts, memes, and videos, expressing excitement over the financial relief.

Many users saw the announcement as a "big gift to the middle class" and even shared personal anecdotes about how this will allow them to make significant purchases, such as cars or homes. The widespread approval was evident from the flurry of tweets, with people exclaiming their newfound financial freedom thanks to the tax exemption on incomes up to Rs 12 lakh.

One user shared their excitement over finally being able to buy a car, while another expressed joy on behalf of working middle-class individuals, saying, "Finally, some relief! This tax exemption will make life a bit easier." The announcement was also met with applause from BJP MPs in Parliament, including Prime Minister Narendra Modi, which further amplified the enthusiasm surrounding the move.

Mixed Reactions : Some Concerns And Confusion

However, while the majority of reactions were positive, a few social media users raised concerns about potential confusion arising from the revised tax regime. Some expressed a desire for more clarity, especially regarding how the new tax structure would affect deductions and the overall tax filing process. These voices questioned whether the simplification of tax laws would be enough to ensure a smooth transition, particularly for those unfamiliar with the intricacies of tax regulations.

Others pointed out that while the new tax slabs were a step in the right direction, the government's focus should also be on reducing the overall cost of living, which remains a challenge for many in the middle class. Despite these concerns, the general sentiment remained one of appreciation, with many netizens eager to embrace the new system once it is formally implemented.

Simplifying Tax Filing : A Move Towards Greater Accessibility

Beyond the financial relief, the new tax regime is also seen as a step towards simplifying the process of tax filing. With tax calculations becoming more straightforward and transparent, the government hopes to encourage more people to opt for the new system. This ease of filing, combined with the direct tax benefits, is expected to make the tax system more accessible and user-friendly, particularly for those who may have found the previous system too complex or burdensome.

By making tax laws more inclusive, the government aims to foster greater compliance and ensure that more individuals participate in the formal economy. As the middle class is the backbone of the Indian economy, this move is expected to not only bring financial relief but also encourage wider economic participation.

The response to the new income tax regime introduced in the Union Budget 2025 has clearly struck a chord with India's middle class. Netizens have celebrated the exemption of income up to Rs 12 lakh, viewing it as a significant financial boost. While there have been some calls for further clarity on the specifics of the new system, the general mood on social media has been one of optimism.

With the new tax structure aimed at easing the financial burden and simplifying the tax filing process, the government's decision seems poised to have a positive impact on millions of taxpayers. How this new regime plays out in practice remains to be seen, but for now, it has certainly garnered approval from a large segment of the population.

Click it and Unblock the Notifications

Click it and Unblock the Notifications